PROPERTY TAX AND CAPITAL GAINS

Posted on 6th June 2023 at 12:26

An update on Property Tax and Capital Gains Tax, following the Government's Spring Update 2023.

Property tax – Reminder

Restricting finance cost relief for individual landlords.

Relief has now been fully restricted to the basic rate of tax for mortgage loan interest on residential lettings.

Property allowance

Individuals have been able to get an allowance of up to £1,000 against their rental income instead of deducting normal expenses.

A loss cannot be created with this allowance, but it could remove the requirement to complete a return.

An equivalent allowance is available against trading income.

Rent a room relief

Rent-a-room relief provides an income tax exemption on residential rental income up to £7,500 where you let out accommodation in your home.

If there are two recipients of the income this relief is halved to £3,750

Capital Gains Tax

From 6 April 2023

Rates remain at 10% and 20% depending on income levels

Gains on residential properties will remain at 18% and 28% for basic and higher rate taxpayers respectively.

The individual CGT exemption will fall from £12,300 to £6,000.

Trust CGT exemption will fall from £6,150 to £3,000.

The disposal of crypto assets must be shown separately on tax returns. Previously, the gains would appear on the tax return in a miscellaneous category combined with other gains.

From 6 April 2024

The individual CGT exemption will fall again to £3,000.

The trust CGT exemption will also fall to £1,500.

Capital Gains Tax - divorce

Currently

All married couples can transfer assets freely through the ‘no gain, no loss provisions’.

For divorcing couples, this provision is only available until the end of the tax year of separation.

From 6 April 2023

Divorcing couples will have up to 3 years in which they are able to make ‘no gain, no loss’ disposals.

Where the assets to be transferred are the subject of a formal divorce agreement, there is now an unlimited period to make these transfers and benefit from the 'no gain, no loss' rules.

Capital Gains Tax – 60 day reporting reminder

Reporting property disposals

For UK residential property disposals, where the property is not your main residence, you have 60 days after the completion date to report and pay any capital gains tax on the disposal.

How to apply

You will need to create a Government Gateway user ID and password.

You would then complete an online form which would calculate the amount to pay. This amount would then be paid on account.

If, when you prepare your annual tax return, you have over or underpaid your CGT this is adjusted in your balancing payment.

Capital Gains Tax – Business Asset Disposal Relief

Reminder - What is it?

Previously known as Entrepreneurs’ Relief

The relief, subject to a number of conditions, is available to:

Sole traders and partners selling the whole or part of their business

Company directors/employees, who own at least 5% of the share capital, selling a ‘material stake’ in a trading company.

A person making an associated disposals

Qualifying disposals will be taxed at a reduced CGT rate of 10%

The lifetime limit remains at £1 million

Statement announced no further changes

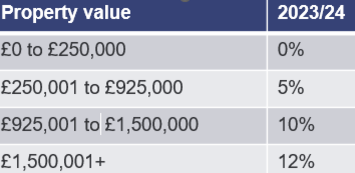

Stamp duty land tax

SDLT reminders

There will be a temporary increase in the nil-rate threshold from £125,000 to £250,000, seen in adjacent table.

First time buyers can now claim a discounted rate where they pay no SDLT up to £425,000, and then 5% on the portion between £425,001 and £625,000 – these are also temporary increases.

If the property value is in excess of £625,000 they revert to the standard rates.

These thresholds will remain in place until 31 March 2025 before returning to the previous, lower bandings after this date.

There is a 3% surcharge if you re buying a second residential property.

There is a further 2% surcharge if you are non-resident.

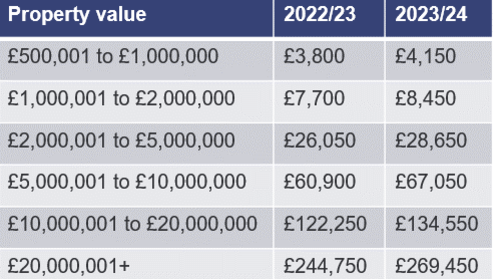

Annual tax on enveloped dwellings

ATED is a fixed charge levied on companies, partnerships with corporate members and collective investment schemes with an interest in UK property valued at more than £500,000.

The bands themselves have not been uprated for inflation and so businesses could see their properties falling into higher bands and now subject to an increased charge.

The 2023 to 2024 chargeable period is a revaluation year for ATED and therefore any companies holding residential property will need to reassess whether they may now breach the £500k threshold and come within the rules for the first time (or be subject to a new banding).

The valuation should have taken place as at 1 April 2022, and the 2023/24 returns and charges will then be due by 30 April 2023.

The new charges will be as follows:

This content will only be shown when viewing the full post. Click on this text to edit it.

Share this post: