PERSONAL ALLOWANCES FROM APRIL 2023

Posted on 17th April 2023 at 16:07

A great deal has happened over the past 6 months.

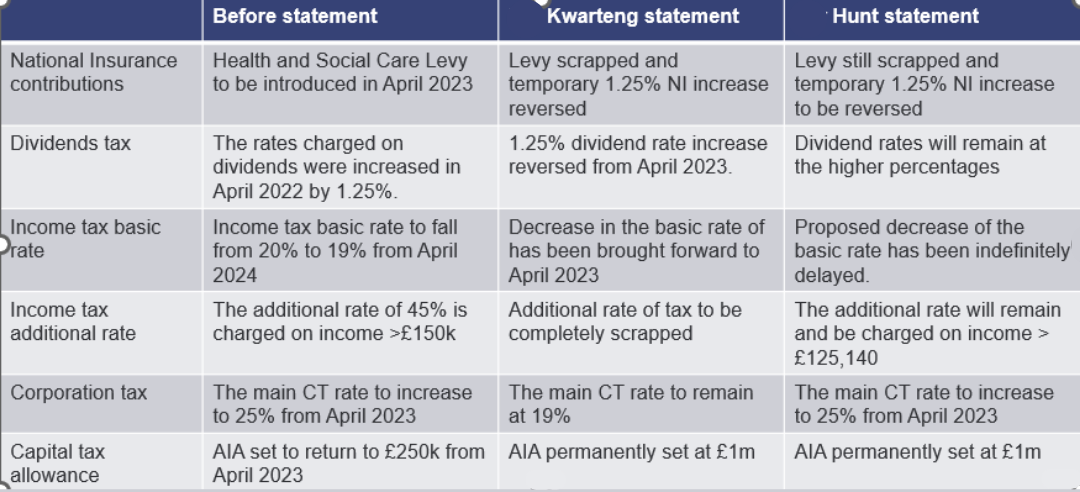

Here is a quick summary of the recent budgets and changes to the UK tax rates:

On 23 September 2022, the Chancellor of the Exchequer, Kwasi Kwarteng delivered a ‘mini-budget’ to the House of Commons, which contained a wide range of tax cuts.

Following the widespread negative response to the mini-budget, the planned abolition of the 45% tax rate was reversed 10 days later, while plans to cancel an increase in corporation tax were reversed 21 days later.

Kwasi Kwarteng was sacked on 14 October.

Jeremy Hunt was appointed as Chancellor and reversed the majority of the tax cuts that had been outlined in the mini-budget.

On 17 November, the chancellor delivered a full autumn statement, announcing further tax increases and cuts in spending.

On 15 March 2023, the chancellor delivered the Spring Budget.

Here is a summary of the changes and reversals:

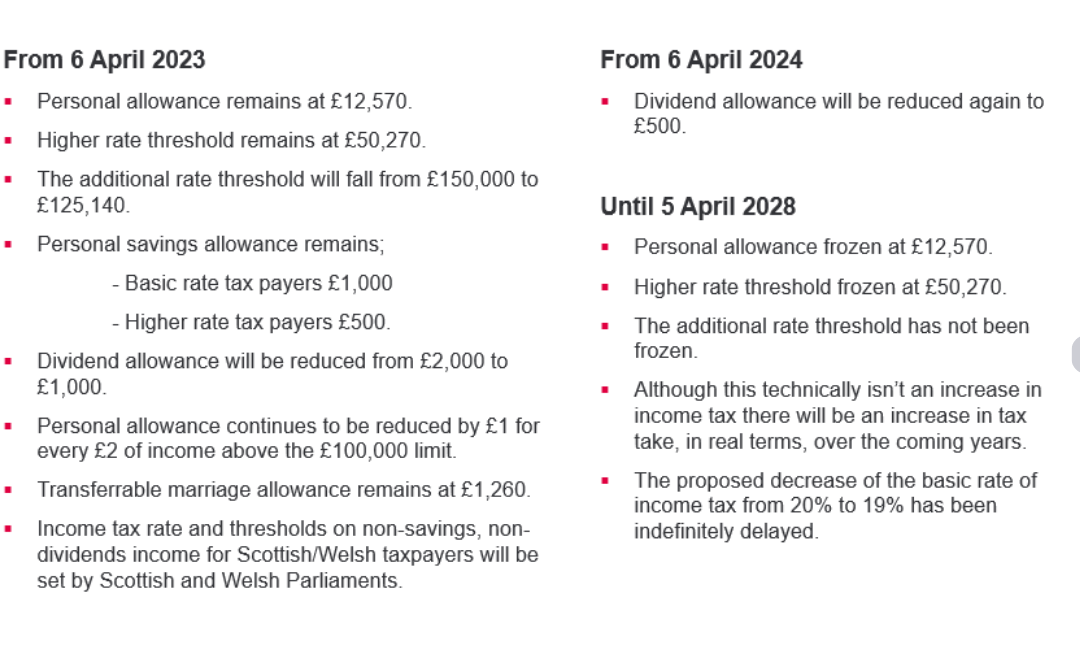

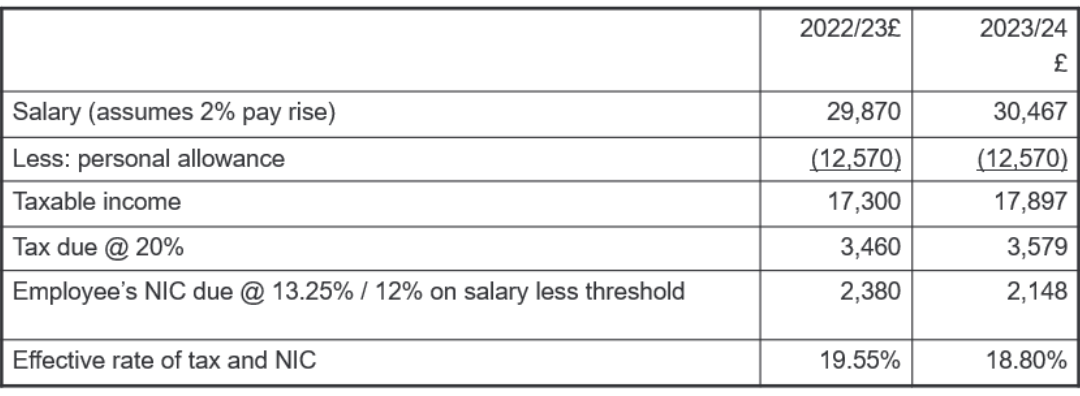

TAX RATES AND BANDS - NATIONAL INSURANCE

Class 1, from 6 April 2023 (current position)

The primary threshold has increased to £242 per week. This is the amount at which an employee is required to make contributions and equates to £12,570 per year, i.e., in line with the Personal Allowance.

The secondary threshold remains unchanged at £175 per week. This is the amount at which an employer is required to make contributions and equates to £9,100 per year.

The upper earnings limit remains unchanged at £967 per week or £50,270 annually and this is the same for both employee and employer.

The Health and Social Care levy has been scrapped and so the employee rates are 0% up to the primary threshold, 12% for earnings between the primary threshold and upper earnings limit and 2% for income over that.

The employer rates are 0% up to the secondary threshold and 13.8% for income over that.

Employment allowance (per employer) remains at £5,000 per year but smaller businesses only i.e. Employer NI bill of £100,000 or more in the previous year will not be able to claim it.

Class 2, from 6 April 2023 (current position)

The threshold at which you will be required to make Class 2 contributions remains unchanged at £6,725.

The weekly rate has increased from £3.15 to £3.45 per week.

This can be paid voluntarily if you are self-employed in order to claim another year for state benefit purposes and is cheaper than making Class 3 voluntary contributions which are now £17.45 per week.

Class 4, from 6 April 2023 (current position)

The lower limit has increased from £11,908 to £12,570, in line with the Personal Allowance.

The upper limit remains unchanged at £50,270.

Class 4 contributions are also subject to 9% for profits between the lower limit and upper limit and 2% above the upper limit.

FREEZING OF THRESHOLDS

All National Insurance thresholds will be frozen, with the lower earnings limit and small profits threshold frozen until April 2024 and all other thresholds frozen until 5 April 2028.

The National insurance secondary threshold will remain frozen at £9,100 until April 2028

Health and Social Care levy

The additional 1.25% Health and Social Care levy has been completely scrapped and will not come into force (for now).

If you have any queries about your personal allowance or any other tax related issue please don't hesitate to contact us.

This content will only be shown when viewing the full post. Click on this text to edit it.

Share this post: