Pensions & Savings in 2023

Posted on 10th July 2023 at 13:31

Discover what the happened to Penions and Savings in the 2023 Government Spring update and how this could impact you.

Pensions and Savings

This is the update regarding pensions and savings following the 2023 Governemtent update.

Individual Savings Accounts (ISAs)

From April 2023

The maximum contribution will remain at £20,000

You can withdraw and repay without using your entitlement.

The Junior ISA will remain at £9,000.

Lifetime ISAs

These continue to be available for 18-40 year olds for those looking to save for their first home, retirement or both.

This ISA lets you save £4,000 annually with the state adding a 25% bonus on top.

You can only withdraw the money when you buy your first home (as a deposit) or after you reach 60 or are terminally ill.

If you withdraw the money for any other reason a 25% penalty will apply.

PENSIONS

Allowances

The lifetime allowance for pension contributions is set to be abolished so there is no limit on the maximum value of a pension pot. The charge is removed in 2023/24 and the cap goes completely in 2024/25.

However, the 25% tax free lump sum draw down remains at £1,073 million. Therefore, an individual’s maximum tax-free draw down is limited to £268,275 (£1.073 million x 25%).

The annual allowance will increase to £60,000 but this is tapered - £1 for every £2 of excess income over £260,000, down to maximum of £10,000 if earnings over £360,000.

Unused annual allowances continue to be carried forward on a rolling basis for 3 years, as long as you have been in a scheme.

State pension

Men and Women aged over 66 will qualify. This is set to increase to 67 between 2026 and 2028.

From 6 April 2023 the basic rate will increase from £141.85 to £156.20 per week

Full state pension increased from £185.15 to £203.85 per week

STATE PENSION ENTITLEMENT

Please be aware that the deadline for plugging gaps on National Insurance records extended from 6 April to 31 July 2023. Up to this date, you can buy missing years going back to 2006 in contributions which would count towards your state pension. After this date can only go back 6 tax years.

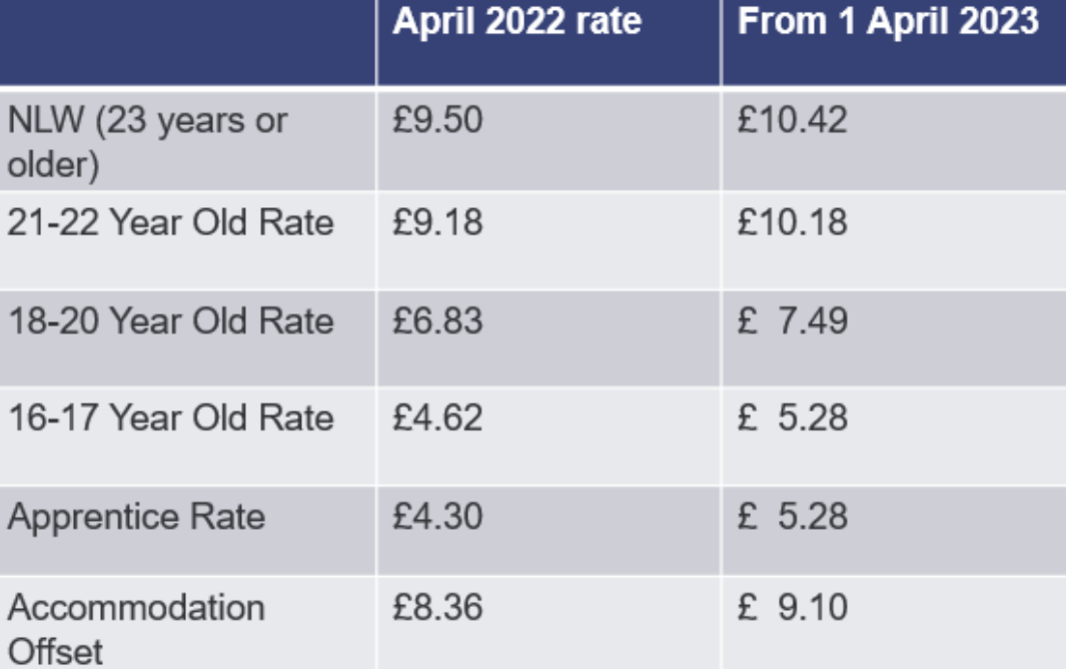

National Living Wage (NLW) and National Minimum Wage (NMW)

If you have any queries about pensions and savings please contact us here.

You can learn more about the budget by reading our blogs or visitng the Government website.

Share this post: