MINI BUDGET SEPT 2022

Posted on 27th September 2022 at 10:49

These are the significant points to be aware of:

reversal of the April 2022 increase in National Insurance rates with effect from 6 November 2022

cancellation of the Health and Social Care Levy that was to be introduced in April 2023

cancellation of the 1.25% addition to dividend tax rates with effect from April 2023

basic income tax rate cut to 19% a year early, from April 2023

abolition of 45% rate of tax on incomes above £150,000 from April 2023

cancellation of planned corporation tax increase to 25% in April 2023: the rate will remain 19%

increases in thresholds for Stamp Duty Land Tax with immediate effect from April 2023

repeal of the ‘off-payroll working’ measures introduced in 2017 and 2021

confirmation of energy cost support packages

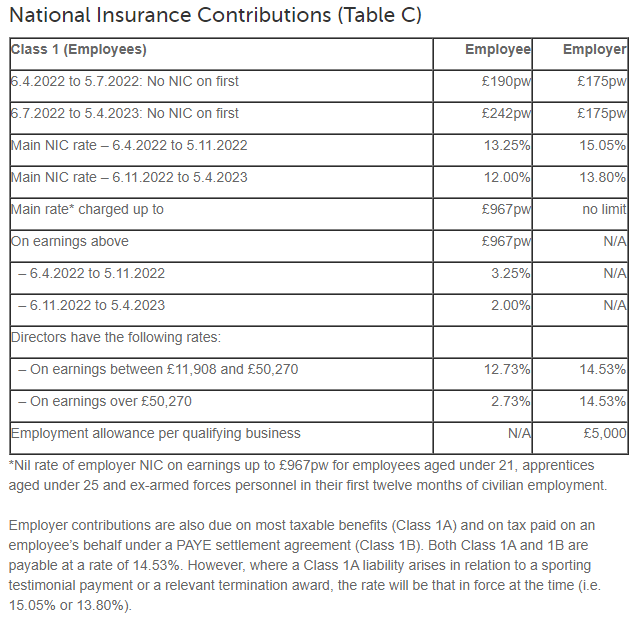

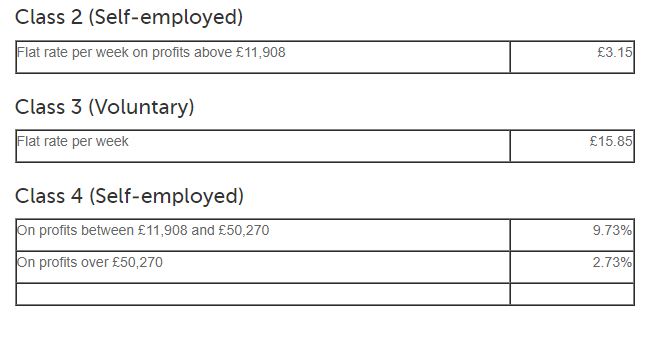

National Insurance Contributions (NIC)

Thresholds and rates

From 6 April 2022, the rates of Class 1 NIC paid by employers and employees, and of Class 4 NIC paid by self-employed people, were increased by 1.25 percentage points.

This means that employees pay 13.25% from the primary threshold up to the upper earnings limit and 3.25% above that; employers pay 15.05% on all earnings above the secondary threshold. Self-employed people pay 10.25% on earnings between the lower and upper profits limits, and 3.25% above the upper limit.

These increases were a temporary measure for the tax year 2022/23, pending the introduction of a separate Health and Social Care Levy (HSCL) to be paid by the same people on the same income from 6 April 2023.

The Chancellor cancelled the HSCL altogether, and also the increases in NIC from 6 November 2022.

In March 2022, Chancellor Sunak moderated the effect of the increase by significantly increasing the primary threshold at which employees’ contributions start, to match the level at which income tax starts to be payable – an annual figure of £12,570. This took effect on 6 July 2022.

Although this increase in the threshold was intended to give relief for the effect of the increase in rates, the threshold has not been reduced following the cancellation of the rate increase.

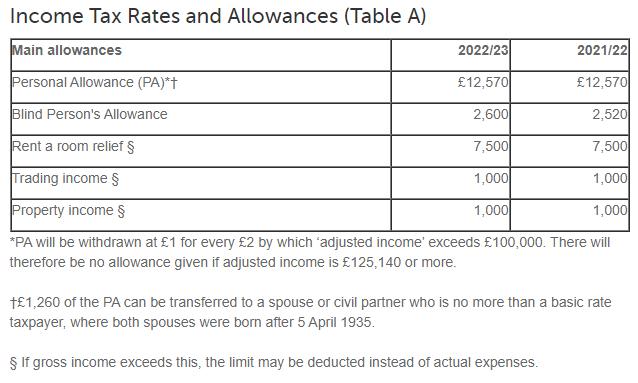

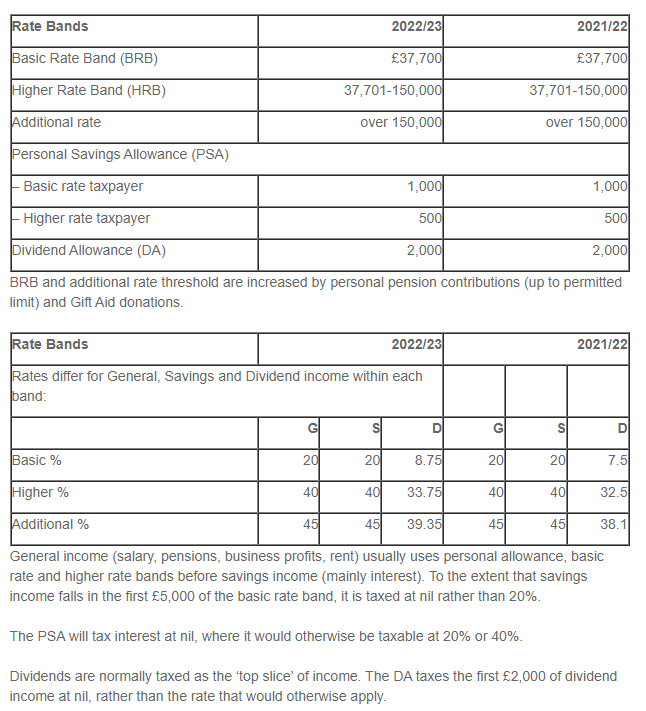

Personal Income Tax

Rates and allowances

In March 2022, Rishi Sunak announced his intention to cut the basic rate of income tax from 20% to 19% from 6 April 2024. Kwasi Kwarteng has brought the cut forward to 6 April 2023. For someone earning over the 40% threshold of £50,270, this will mean a reduction in income tax of £377 in 2023/24.

The 45% rate of tax that applies to income above £150,000 a year will be abolished from 6 April 2023, leaving only the basic rate of 19% and the higher rate of 40%.

These cuts will not automatically apply in Scotland, where tax rates on non-savings, non-dividend income are set by the Scottish Parliament.

The Welsh Assembly also has the right to set its own tax rates for non-savings, non-dividend income, but has so far kept to the main UK rates.

Dividend income

For the tax year 2022/23, the tax rates on dividend income over £2,000 were increased to correspond to the increases in National Insurance Contributions and the planned Health and Social Care Levy. The ordinary rate, paid by basic rate taxpayers, rose from 7.5% to 8.75%; the upper rate (for higher rate taxpayers) is 33.75% (from 32.5%) and the additional rate (for those with income above £150,000 a year) is 39.35% (from 38.1%). These rates apply across the UK.

These increases will be reversed with effect from April 2023. Combined with the abolition of the additional rate of income tax, this means that there will only be rates of 7.5% and 32.5% on dividend income above £2,000 in 2023/24.

Corporation Tax

Rate of tax

As widely expected, the Chancellor confirmed that the planned increase in the main rate of corporation tax from 19% to 25% will not now take place on 1 April 2023.

Stamp Duty Land Tax (SDLT)

Thresholds

With effect from 23 September 2022, the threshold above which SDLT must be paid on the purchase of residential properties in England and in Northern Ireland will be doubled from £125,000 to £250,000. At the same time, the thresholds for first-time buyers will increase from £300,000 to £425,000 and the maximum value of a property on which a first-time buyer can claim relief will increase from £500,000 to £625,000.

This content will only be shown when viewing the full post. Click on this text to edit it.

Share this post: