Tax rates and bands – National Insurance

Posted on 12th July 2022 at 10:13

Class 1, from 6 April 2022 (current position)

Details of the 2022 Government's Spring update regarding tax rates and bands - National Insurance.

What does this mean to employers and employees?

The primary threshold increased from £184 to £190 per week.

This is the amount at which an employee is required to make contributions and equates to £9,880 per year.

The secondary threshold increased from £170 to £175 per week.

This is the amount at which an employer is required to make contributions and equates to £9,100 per year.

The upper earnings limit remains unchanged at £967 per week or £50,270 annually.

This is the same for both employees and employers.

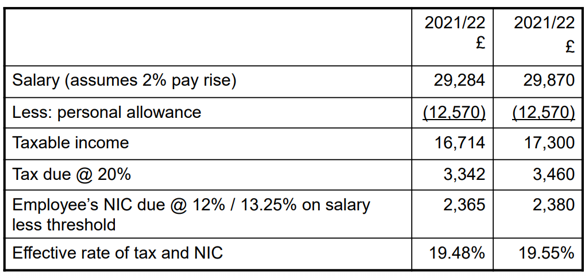

Employee rates will now be subject to a 1.25% Health and Social care levy and so are 0% up to the primary threshold, 13.25% for earnings between the primary threshold and upper earnings limit and 3.25% for income over that. This levy is also applied to employers and so the rates are 0% up to the secondary threshold and 15.05% for income over that.

Employment allowance (per employer) will be increased from £4,000 to £5,000 per year but smaller businesses only i.e. An employer NI bill of £100,000 or more in the previous year will not be claimable.

Changes from 6 July 2022

The primary threshold and Lower profits limit will be increased to be in line with the personal allowance, £12,570

The secondary threshold remains unchanged.

What does this mean for an employee?

From 6 July 2022 employees will be able to earn £242 a week without incurring a NI liability. Combining this with the first three months of the year, this equates to an annual salary of £11,908 for 2022/23. This will be in line with the personal allowance from 2023/24.

What does this mean for the self-employed?

For 2022/23 the self-employed will be able to earn £11,908 before paying Class 2, Class 4 or the levy.

This will be £12,570 from 2023/24.

If you have any queries about National Insurance please don't hesitate to contact us.

Tagged as: 2022, allowances, employees, employers, National Insurance allowance, personal tax allowance, tax

Share this post: