Property Tax and Capital Gains Tax

Posted on 27th July 2022 at 11:35

Property tax

Restricting finance cost relief for individual landlords

Relief has now been fully restricted to the basic rate of tax for mortgage loan interest on residential lettings.

Property allowance

Individuals have been able to get an allowance of up to £1,000 against their rental income instead of deducting normal expenses.

A loss cannot be created with this allowance, but it could remove the requirement to complete a return.

An equivalent allowance is available against trading income.

Rent a room relief

Rent a room relief provides an income tax exemption on residential rental income up to £7,500 when you let out accommodation in your home.

If there are two recipients of the income this relief is halved to £3,750

If you have any queries about property or capital gains tax please contact us here.

Capital Gains Tax

From 6 April 2022

Rates remain at 10% and 20% depending on income levels

Gains on residential properties will remain at 18% and 28% for basic and higher rate taxpayers respectively.

Individual CGT exemption remains at £12,300 and will be frozen at this level until at least 2025/26.

Trust CGT exemption remains at £6,150 and will be frozen at this level until at least 2025/26.

Capital Gains Tax – 60 day reporting reminder

Change to time limit

For UK residential property disposals, where the property is not your main residence, you previously had 30 days after the completion date to report and pay any capital gains tax on the disposal.

This has now been extended to 60 days for all completions after 27 October 2022

How to apply

You will need to create a Government Gateway user ID and password.

You would then complete an online form which would calculate the amount to pay. This amount would then be paid on account.

When you prepare your annual tax return, if you have over or underpaid your CGT this is adjusted in your balancing payment.

Capital Gains Tax – Business Asset Disposal Relief

What is it?

– This was previously known as Entrepreneurs relief

– The relief, subject to a number of conditions, is available to:

Sole traders and partners selling the whole or part of their Business

Company directors/employees, who own at least 5% of the

share capital, selling a ‘material stake’ in a trading company.

A person making associated disposals

– Qualifying disposals will be taxed at a reduced CGT rate of 10%

– The lifetime limit remains at £1 million

– Statement announced no further changes

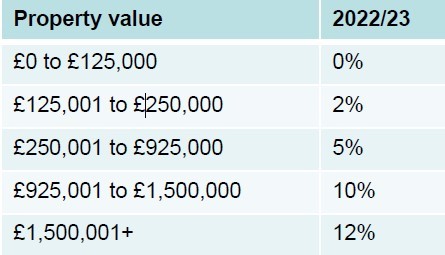

Stamp duty land tax

SDLT reminders

The SDLT holiday has now ended and the rates revert to the level before Covid, seen in the table below.

First time buyers can claim a discounted rate where they pay no SDLT up to £300,000, 5% on the portion between £300,001 and £500,000.

If the property value is in excess of £500,000 they revert to the standard rates.

There is a 3% surcharge if you're buying a second residential property.

There is a further 2% surcharge if you are non-resident.

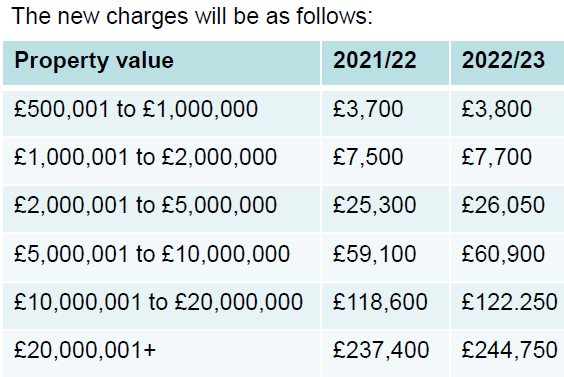

Annual tax on enveloped dwellings

ATED is a fixed charge levied on companies, partnerships with corporate members and collective investment schemes with an interest in UK property valued at more than £500,000.

The bands themselves have not been uprated for inflation and so businesses could see their properties falling into higher bands and now subject to an increased charge.

2022 is a revaluation year for ATED and therefore any companies holding residential property will need to reassess whether they may now breach the £500k threshold and come within the rules for the first time (or be subject to a new banding).

Although the valuation should take place as at April 2022, this will not take effect until 2023/24 filings. 2022/23 returns and charges due by 30 April 2022 and will still be based on 2017 valuations.

Capital Gains Tax – Business Asset Disposal Relief

What is it?

Previously known as Entrepreneurs relief – The relief, subject to a number of conditions, is available to:

Sole traders and partners selling the whole or part of their business

Company directors/employees, who own at least 5% of the share capital, selling a ‘material stake’ in a trading company.

A person making an associated disposals – Qualifying disposals will be taxed at a reduced CGT rate of 10% – The lifetime limit remains at £1 million – Statement announced no further changes

If you have any questions about Property or Capital Gains Tax, please contact us here.

If you have any queries about property or capital gains tax please contact us here.

Tagged as: property tax, tax

Share this post: